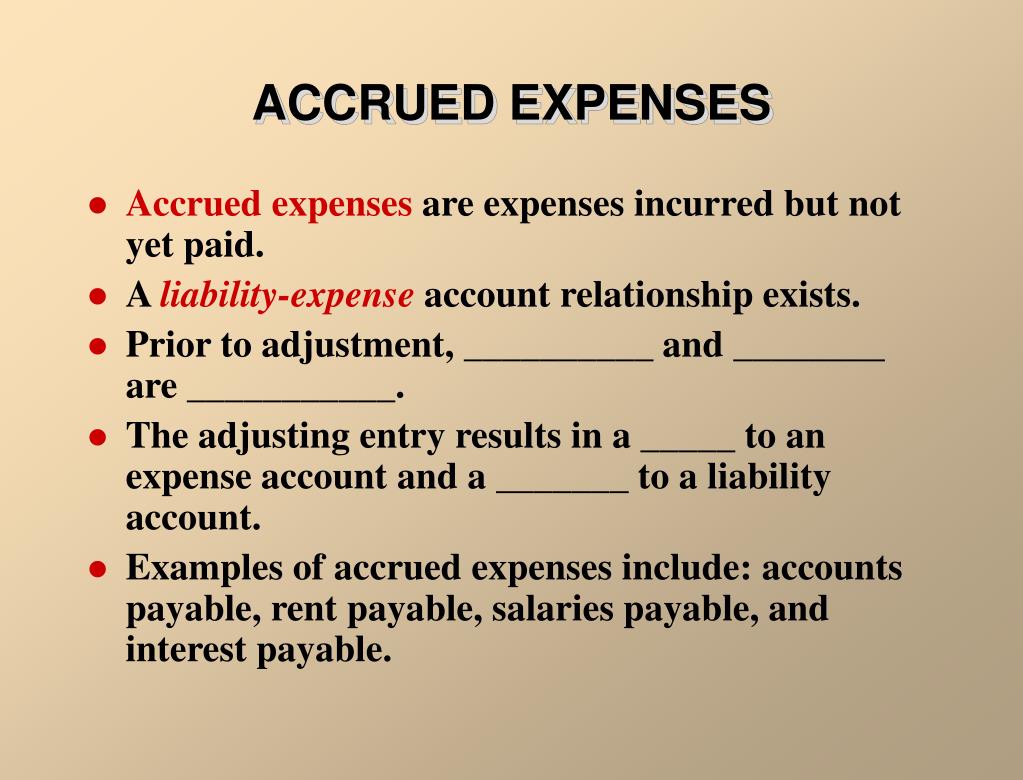

The difference between them is that accrued expenses are accumulated liabilities. The difference between accrued expenses and accounts payableīoth accrued expenses and accounts payable are recorded on a company’s balance sheet under current liabilities. With prepaid expenses, assets are paid for in advance and then used. With accrued expenses, assets are used and then paid for. The difference between accrued expenses and prepaid expensesĪccrued expenses are the opposite of prepaid expenses.

#Accrued expense how to

How to record accrued expensesĪccrued expenses are recorded on a company’s balance sheet under current liabilities.

Smaller businesses will typically use cash basis accounting. This means it creates more work, meaning more potential for mistakes.Īs a result, accrual accounting is generally only used by larger businesses. The main drawback of using accrual accounting is that it is more complex than cash basis accounting. In particular, it can lead to difficulties with cash flow and future tax liability. This can make it difficult for business owners and managers to create accurate forecasts. This can lead to income appearing higher than it is and liabilities appearing lower than they are. With cash-basis accounting, by contrast, there can often be a significant delay between an expense incurred and the associated payment made. This means accounting records provide stakeholders with a much clearer and more accurate picture of a company’s financial health. The main benefit of accrual accounting is that it creates a real-time record of a company’s financial activities. In some cases, this means the company has to estimate how much the cost will be.

#Accrued expense software

So, it enters the expenditure into its accounting software in December. The company, however, chooses to record them as accrued expenses. The equipment is sent immediately with the invoice to follow in the supplier’s next billing cycle.Īll of these extra costs only become payable in January. It, therefore, invests in new equipment to help lighten the workload. It also takes on seasonal employees and hires freelancers to help with certain key tasks.Įven with this extra help, the company has to work very long hours to meet the demand. It, therefore, offers its permanent employees overtime. Let’s say that a travel company knows that December is its busiest period.

Examples of accrued expensesĬommon examples of accrued expenses include: Accrued expenses are also known as accrued costs and accrued liabilities. An accrued expense is an expense recorded in a company’s accounting records when the asset is used rather than when the related payment is made.

0 kommentar(er)

0 kommentar(er)